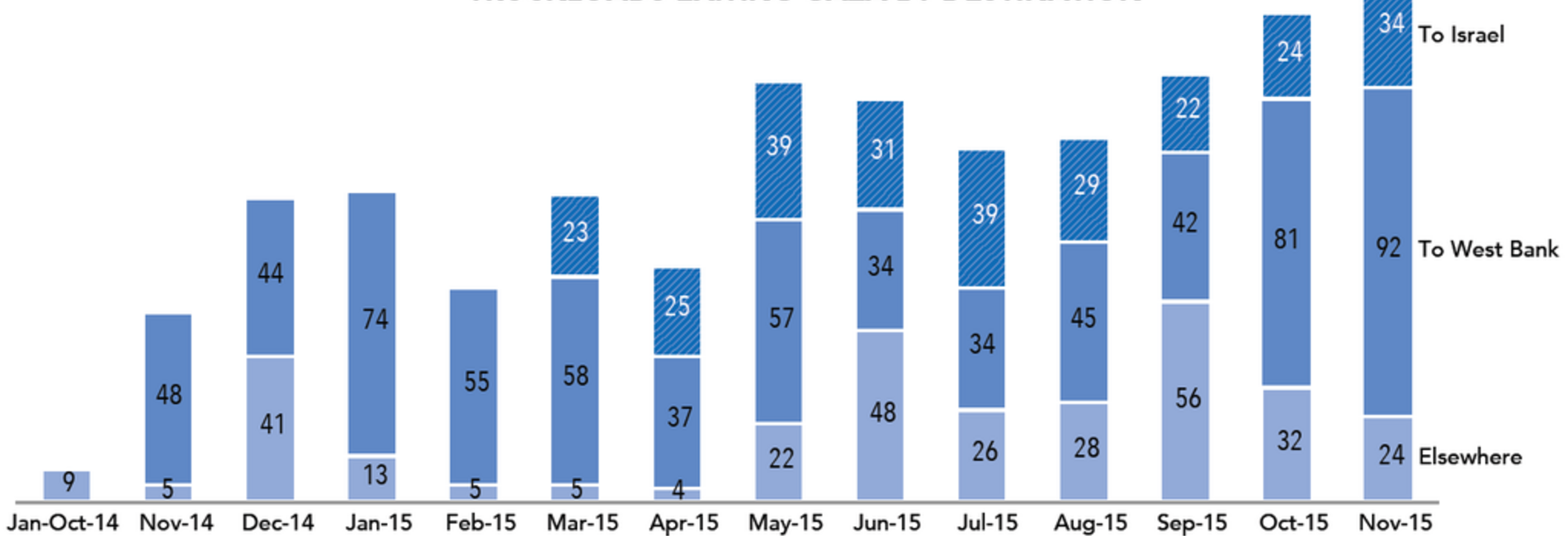

Sharp increase in exports and transfers from Gaza during 2015

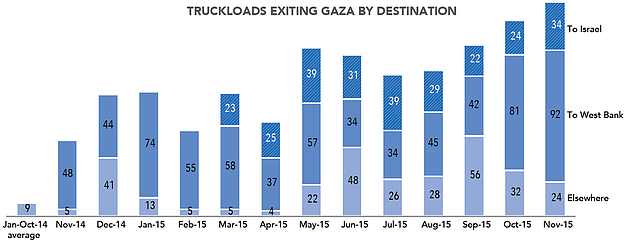

During November 2015, a total of 150 truckloads of commercial goods left Gaza, the largest figure in a single month since the imposition of the blockade in June 2007. This brings the number of truckloads marketed outside Gaza between January and November 2015 to 1,138, a five-fold increase over all of 2014. The volume of imports into the Gaza Strip also increased significantly during 2015.[1]

The growth in exports and transfers from Gaza started in November 2014 following the easing of longstanding Israeli restrictions. The lifting of the ban on the transfer of goods to the West Bank, and subsequently also to Israel, resulted in over three-quarters of the truckloads exiting Gaza in 2015 being delivered to these two destinations, compared with almost none in previous years. The ban on the exit of non-agricultural goods was also eased and 12 per cent of truckloads from Gaza in 2015 (mainly to the West Bank) contained furniture, clothes, stationery and scrap metal.

Volume of goods remains a fraction of pre-blockade figures

Despite the easing of restrictions, the average number of truckloads from Gaza in 2015 was less than 10 per cent of the equivalent figure during the first five months of 2007, prior to the imposition of the blockade. The limited progress can be attributed to a range of factors that undermine Gaza’s productive capacity: previous and current Israeli restrictions on imports and exports, and their cumulative effect; the destruction of productive assets during multiple rounds of hostilities; the inadequate and unreliable electricity supply; and disputes related to the internal Palestinian divide.

Exports of furniture to Israel, a significant component of pre-blockade exports, were reportedly approved by the Israeli authorities earlier this year. However, implementation remains stalled for a variety of reasons that include disagreement between the authorities in Gaza and Ramallah on the handling of Value Added Tax (VAT) invoice requirements, and the recent Israeli ban on imports of wood planks thicker than one centimetre, citing security reasons. According to the Wood Industry Union in Gaza, these new restrictions on wood imports have already caused shrinkage of over 30 per cent in furniture production and a rise in furniture prices.

Slight decline in unemployment

In the third quarter of 2015 (July-September), the unemployment rate in Gaza stood at 42.7 per cent.2 While this remains one of the highest in the world, it represents a drop of five percentage points from the figure recorded in the equivalent quarter of 2014 (47.4 per cent), reflecting the generation of a total of 44,300 new jobs, mostly in the construction sector but also in export-related activities.

A more significant increase in economic activity requires the consistent exit of goods to all destinations. This must be supplemented by additional measures, including (but not limited to): the lifting of import restrictions on raw materials; the reconstruction of facilities and productive assets damaged during hostilities; an adequate electricity supply; and more efficient utilization of existing capacity at the Kerem Shalom crossing.

[1] For further details on import trends see: OCHA, Gaza Crossings Monthly Update, November 2015.